WV-2848, the West Virginia State Tax Department Authorization of Power of Attorney is a legal document and a tool designed to instigate an associate to deal with the various tax matters mentioned in the document with the West Virginia State Tax Department. Submit duly filled and notarized form WV-2848 power of attorney to West Virginia State Tax Department, Revenue Division, Post Office Box 2389, Charleston, West Virginia 25328-2389.

The grant of handling the tax affairs with the West Virginia State Tax Departments is subjected to the mention of the specific Tax types and transaction type. It is not restricted to exceptions unless and otherwise stated in the WV-2848. It also makes a provision to issue the grant f transaction and right to information only on specifying those affairs. Thus, the sighing principle can control the application and effectiveness of the power of attorney. Thus, power of attorney form WV-2848 is applicable to those specified powers granted here within.

How to Fill the West Virginia Tax Department Authorization Power of Attorney (WV-2848)

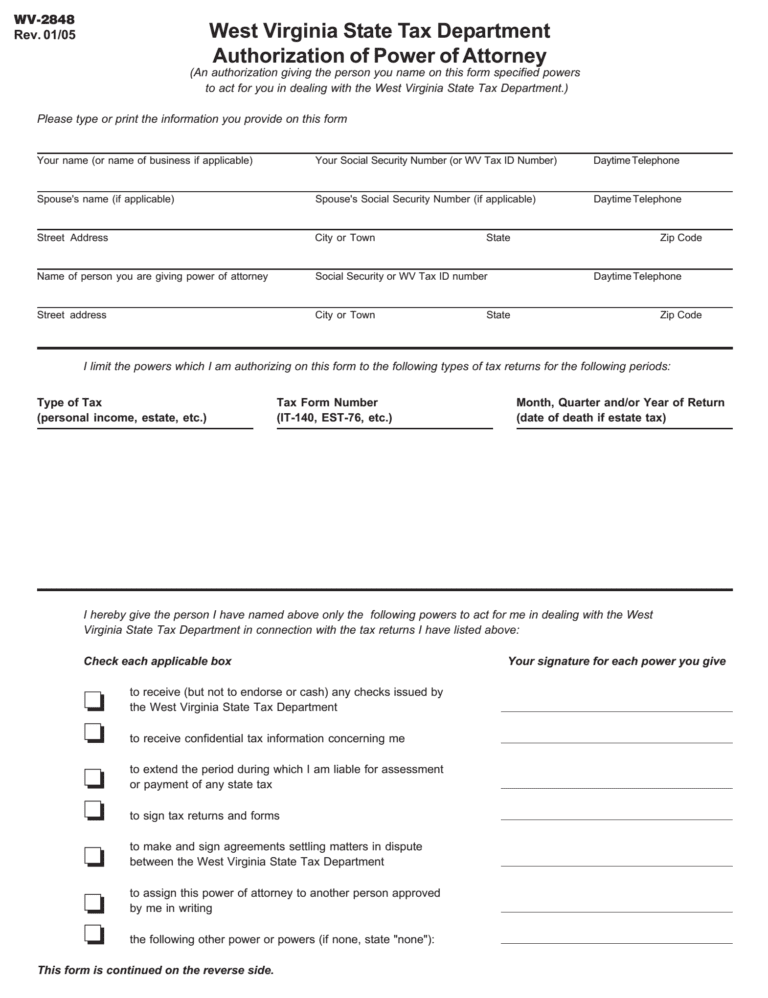

WV-2848 is a two-page form with the provision for notarization for its legal standing. The form allots the powers to transact within the defined scope of tax affairs. Write the personal name or business name of the signing principle as applicable in the foremost part of WV-2848. Then mention Social Security Number and/or WV Tax ID Number as applicable. Write the daytime telephone number. Write Spouse’s name, SSN and/or WV Tax ID Number, and daytime phone number if necessary. Write the street address, city and state name, and zip code in the space available for the same on the next line.

Then write the name of the person under the grant of power of attorney, his/her SSN and/or WV Tax ID number, and daytime phone number along with the street address, city, state, and zip code.

Next portion is decisive in governing the scope and limitations of the WV-2848 power of attorney. Write the type of tax, then tax form number, and Month, Quarter and/or Year of Return. Write the date of death in the case of the Estate Tax as applicable.

Write the name of the representative above the powers to be granted in acceptance of a grant of powers mentioned within the scope of Form WV-2848. Mark your choice in the box and sign in front of the choice to grant the powers to take action on these affairs. Select as many choices as necessary and applicable among the 7 options available. Signing these sections of the Form WV-2848 grants the abilities to transact as and when necessary.

Taxpayer/s and spouse’s signature date, and daytime telephone numbers are required in the space available in the next section. Signature and title of the corporate officer, partner or fiduciary authorized to execute this power of attorney on behalf of the taxpayer is required in the space provided for the same. Write the date and daytime phone number in the respective spaces.

Fill in the details either of the witnesses or of Notarization as and when applicable when the assignee of the Form WV-2848 the power of attorney is an individual other than the attorney or certified public accountant.

<center> <script id="mNCC" language="javascript"> medianet_width='728'; medianet_height= '90'; medianet_crid='471678525'; </script> <script id="mNSC" src="http://contextual.media.net/nmedianet.js?cid=8CUA2TM0E" language="javascript"></script> </center>Download Links

West Virginia Tax Department Authorization Power of Attorney

Preview West Virginia Tax Department Authorization Power of Attorney (WV-2848)

West Virginia Tax Department Authorization Power of Attorney (WV-2848)