FedEx Customs Power of Attorney Form is used when you want FedEx to be your customs broker and want to appoint them as your attorney-in-fact and deal with the customs while importing or exporting your products and merchandise.

How to Fill the FedEx Customs Power of Attorney Form

Begin the form by carefully reading and understanding the terms and conditions of the service which shall help in identifying the powers vested in the agent, how they are supposed to be used and to which extent. It will also help in filling the form.

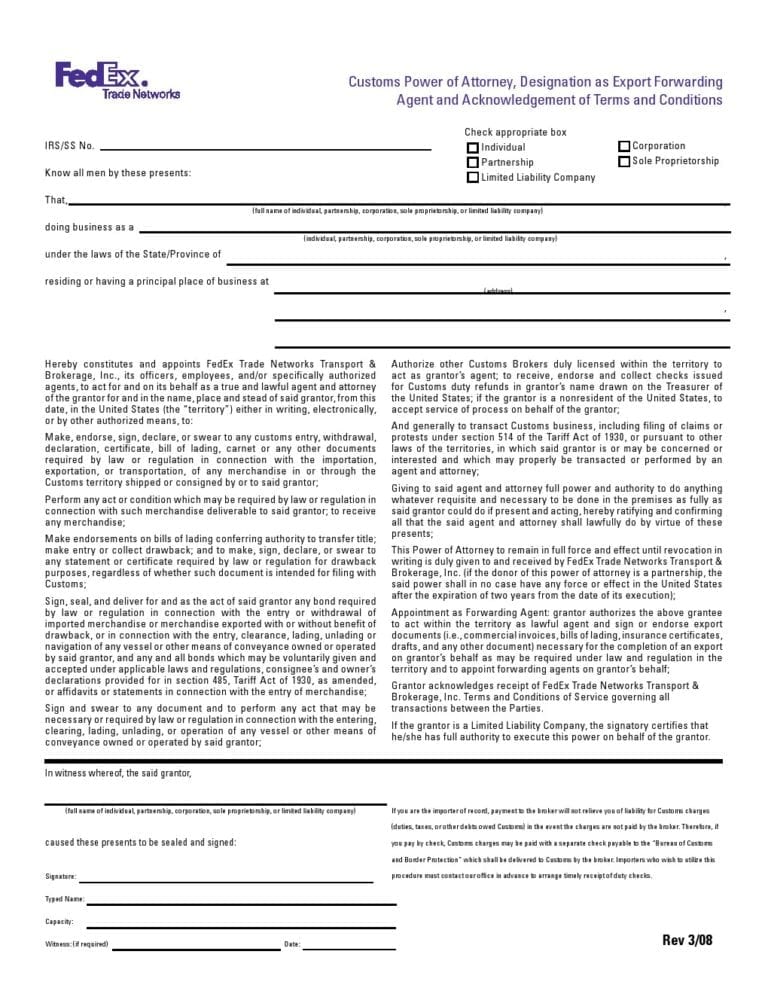

Then provide the IRS # (Internal Revenue Service) or the SSN (Social Security Number) of the grantor followed by choosing the status of the company from the options Individual, Corporation, Partnership, Sole Proprietorship or Limited Liability Company.

In the blank field below it, fill in the full and legally registered name of either the company along with the name of the state under whose laws they are doing business or the name of the individual with the type of organization they are running (whichever applicable) and the complete address of the office from where the business is operated with the city, state & zip code.

In the next few fields, all the powers that are given to the agent are stated along with a detailed description of how, where and when can they be used to represent on the grantor’s behalf along with the relevant laws. These may include anything and / or everything ranging from bill for customs, collection of checks issued for the Customs duty refunds in grantor’s name, importation, exportation or transportation of the goods, legal procedures, any documentation pertaining to the customs, etc!

Lastly, state the full and legal name of the individual or the corporation who is also referred as the grantor followed by the fully legal name of the person who is authorized to sign this document along with their signature, the title they hold in the company and the full name of the witness (if required) along with the present date on which the document is being executed.

In the end, this document also has to be notarized by the Notary Public for legal purposes along with filling in the corporate certification form with the necessary details as indicated on the form (if required).

<center> <script id="mNCC" language="javascript"> medianet_width='728'; medianet_height= '90'; medianet_crid='471678525'; </script> <script id="mNSC" src="http://contextual.media.net/nmedianet.js?cid=8CUA2TM0E" language="javascript"></script> </center>Download Links

Fedex Customs Power of Attorney Form

Preview FedEx Customs Power of Attorney Form

FedEx Customs Power of Attorney Form

One comment

Comments are closed.