The Colorado Tax Matters Power of Attorney Form is used when you want to authorize someone else to receive and inspect your confidential tax information and to perform any acts related to Taxation on behalf of yourself. However the agent is not authorized to collect refund checks. You may specify what tasks you want the agent to perform on your behalf by striking out sections given in the form. This form can only be used in the State of Colorado.

How to Fill the Colorado Tax Maters Power of Attorney Form

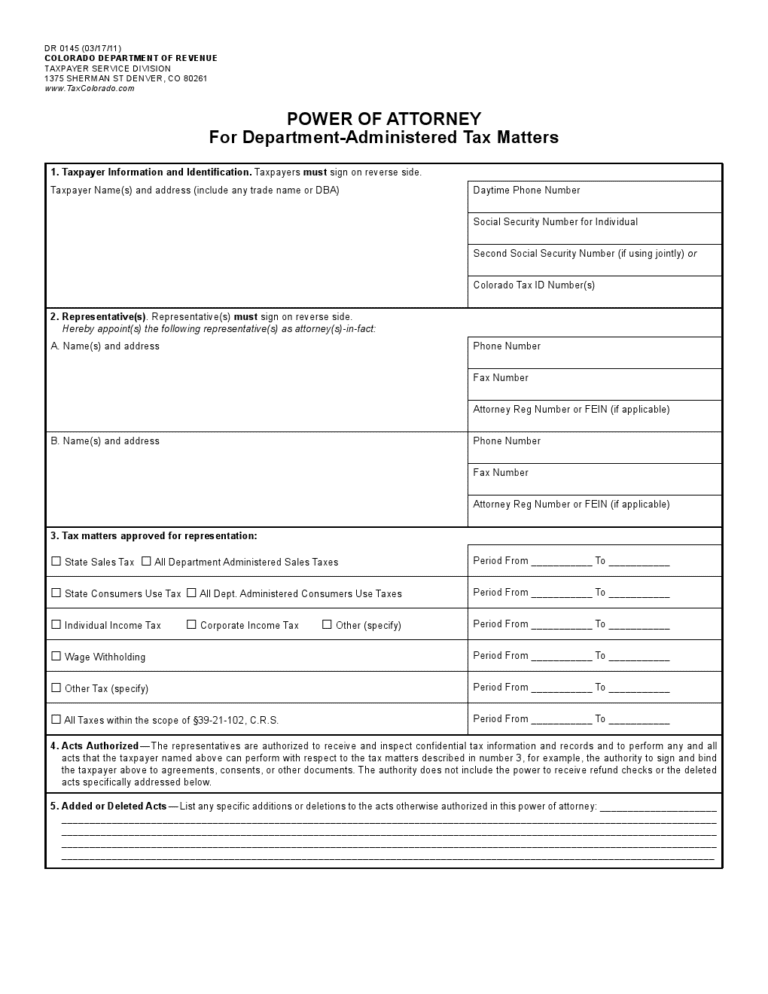

The form begins with the address where the form needs to be filled and submitted followed by the complete information and identification of the taxpayer including the full and legal name (first, middle, last), full address with the zip code, day time phone number, Social Security Number for individual, Social Security Number (if using jointly) & Colorado Tax ID Number/s. After that the complete information of the representative/s must be given including the full and legal name (first, middle, last) along with the full address and the zip code, phone number, fax number and Attorney Registration Number or FEIN (if applicable).

In the third section, there is a list of tax matters wherein the taxpayer needs to choose which matters is the attorney-in-fact applicable to represent them in. This list includes matters such as sales tax, state consumers use tax, individual income tax, corporate income tax, wage withholding, other taxes or All Taxes within the scope of §39-21-102, C.R.S followed by the start and the end date of the power individually. After that acts that the attorney-in-fact or the representative is authorized to perform are stated for reference.

In the fifth section, mention the acts that are to be added or deleted. Filling this form shall revoke any other tax related attorney’s and if you wish to keep them in power then their details should be stated in the next section.

Lastly, the full name and the signature of the principal needs to be inked followed by the signature of the representative/s certifying the transfer of power in matters related to taxation along with confirmation of how the attorney will be representing the taxpayer.

Download Links

Colorado Tax Matters Power of Attorney Form

Preview Colorado Tax Matters Power of Attorney Form

Colorado Tax Matters Power of Attorney Form