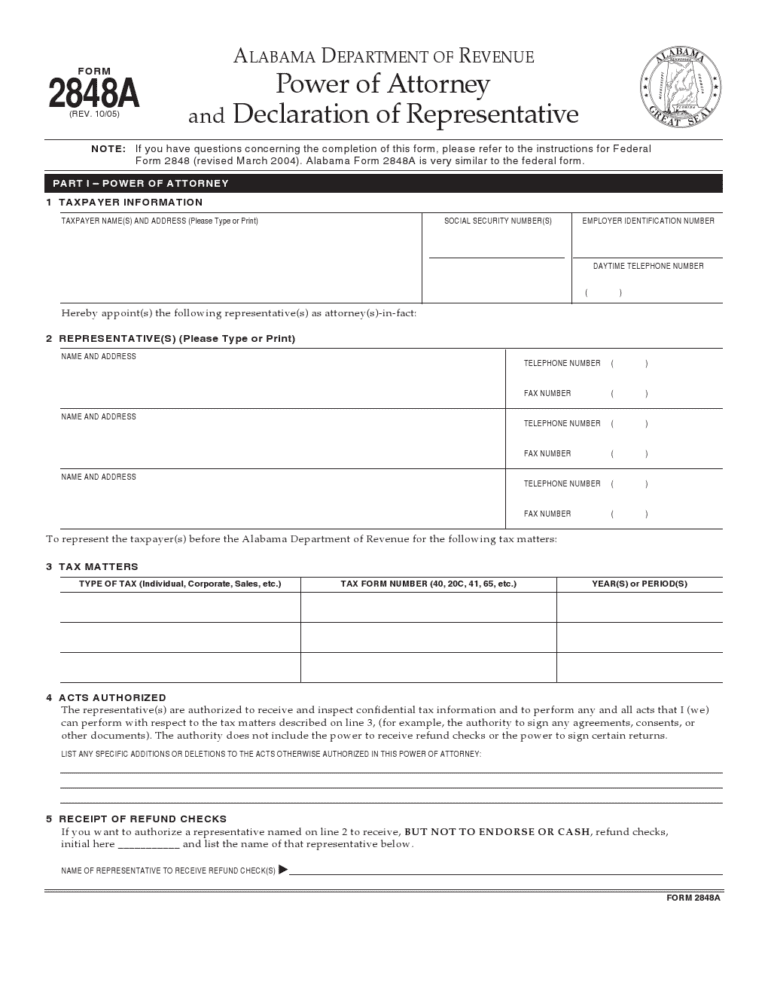

The Alabama Power of Attorney for Taxes Form or also known as Alabama Power of Attorney and Declaration of Representative (Form 2848A) is used when you want to authorize someone else on to represent you before the IRS. You must make sure the person you authorize is eligible to practice before the IRS.

This Power of Attorney form only grants the authorized person to request and inspect your confidential tax information and to perform acts such as sign any agreements, consents or any other documents related to Taxes. The authorized person has no rights to receive refund checks or the power to sign certain returns, however if you wish to authorize the person to collect the refund checks but not to endorse or cash them you may do so.

The Form 2848A is very similar to the Federal Form 2848.

How to Fill the Alabama Power of Attorney Taxes Form

The first section begins with the detailed information of the taxpayer or the first and primary party including their full and legal name (first, middle, last) along with the complete address with the zip code, social security numbers, employer identification number and the daytime phone number. Followed by the detailed information of the representative which should include the full and legal name (first, middle & last) along with the complete address and zip code, telephone number and the fax number. The next section should be filled with the tax matters including the types of tax (individual, corporate, sales, etc.), tax form number (40, 20C, 41, 65, etc.) & year or period.

In the fourth section, the acts that are authorized to the representative are stated and if there are any additions or restrictions to the otherwise authorized also needs to be mentioned. After that, you need to sign your initials if you want to authorize the appointee to receive refund checks “but not to endorse or cash it” followed by the name of the representative who will receive them.

Here in the sixth section, select the options you want the representatives to receive notices for communication. Next, check the box if you want any earlier appointed power of attorney to remain in effect (attach a copy of the power of attorney for whom you want to do the same).

Lastly, the taxpayer needs to sign the document along with their full name, date and title followed by a signature of the representative under the declaration including the designation, jurisdiction (state) or enrolment card no. and date.

<center> <script id="mNCC" language="javascript"> medianet_width='728'; medianet_height= '90'; medianet_crid='471678525'; </script> <script id="mNSC" src="http://contextual.media.net/nmedianet.js?cid=8CUA2TM0E" language="javascript"></script> </center>Download Links

Alabama Power of Attorney For Taxes Form

Alabama Power of Attorney For Taxes Form

Preview Alabama Power of Attorney For Taxes Form 2848A

Alabama Power of Attorney For Taxes Form 2848A