The Arizona Tax Power of Attorney Form is used when an individual wants to assign or authorize another person to represent himself before the IRS or to perform acts such as sign agreements, access and inspect confidential tax information etc on his behalf in the State of Arizona. The representative however may not have rights to en-cash the refunds or receive refund checks.

How to fill the Arizona Tax Power of Attorney Form(285-I)

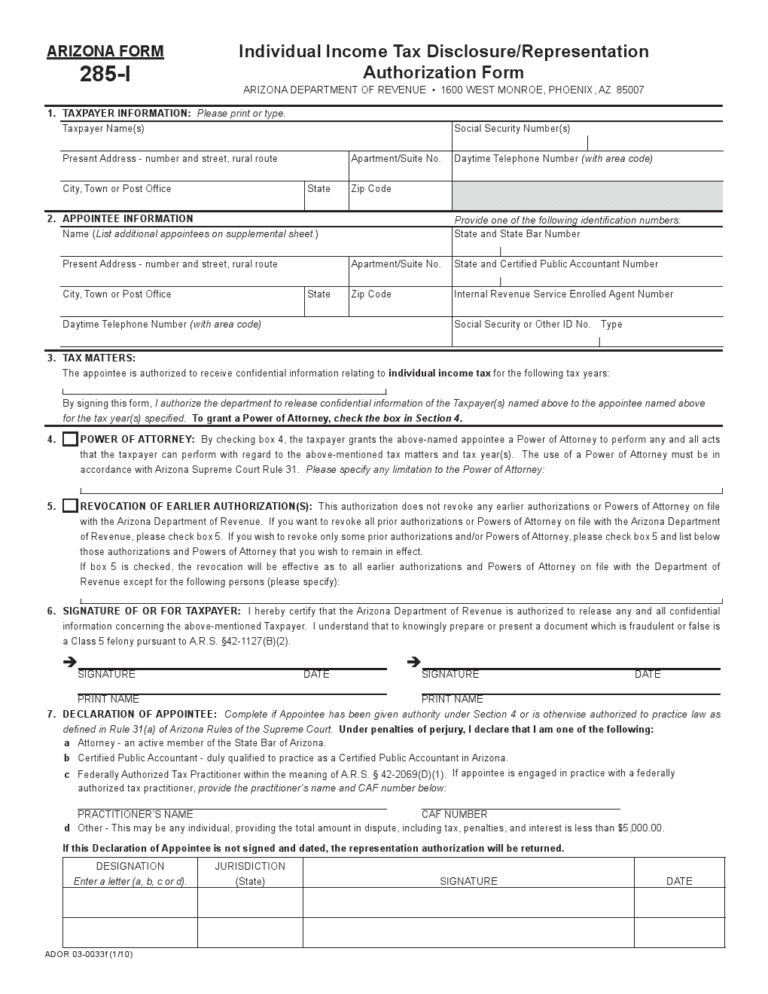

The form needs to begin with the full and legal name (first, middle, last) of the taxpayer along with the complete address with the county, state & zip code, social security number & daytime phone number followed by the full and legal name (first, middle, last) of the representative along with the complete address including the county, state and zip code, daytime phone number and one of the following; state and state bar number, State and Certified Public Accountant Number, internal Revenue Service Enrolled Agent Number or Social Security or Other ID No. and Type needs to be mentioned in the next section.

In the 3rd, 4th & 5th section, the taxpayer needs to mention the years for which the attorney-in-fact is entitled to receive the confidential income tax information followed by the check on the check box and the restrictions implied on the attorney needs to be stated (if any). If you wish to revoke all or few previous power of attorney/s this fifth box needs to be checked and the ones which are to remain should be named.

Lastly, the taxpayer needs to sign the document along with their name and date certifying the transfer of authority and that the agents decision shall be equal to theirs. The declaration of the appointee (attorney-in-fact) also needs to be filled in the column with one of the following option chosen; a. Attorney – an active member of the State Bar of Arizona, b. Certified Public Accountant – duly qualified to practice as a Certified Public Accountant in Arizona, c. Federally Authorized Tax Practitioner within the meaning of A.R.S. § 42-2069(D)(1) or d. Other – This may be any individual, providing the total amount in dispute, including tax, penalties, and interest is less than $5,000.00 along with jurisdiction and the date.

<center> <script id="mNCC" language="javascript"> medianet_width='728'; medianet_height= '90'; medianet_crid='471678525'; </script> <script id="mNSC" src="http://contextual.media.net/nmedianet.js?cid=8CUA2TM0E" language="javascript"></script> </center>Download Links

Arizona Tax Power of Attorney Form

Preview Arizona Tax Power of Attorney Form 285-I

Arizona Tax Power of Attorney Form 285-I