This is a Florida Tax Power of Attorney Form (Form DR-835) which is used to grant power of attorney related to your tax and taxation matters to a representative will act on your behalf with the Department of revenue. This form has all the sections required to create a proper power-of-attorney for taxation purposes.

How to fill this Florida Tax Power of Attorney Form (Form DR-835)?

The first part of this form is contained to help you provide details about the power of attorney and its functioning. In section one you need to enter your (taxpayer) information, like your name and address your federal ID number, your Florida tax registration number, your contact person, telephone number and/or fax number. In Section two you need to add the names of the representatives to whom you are going to give the power-of-attorney, along with their telephone numbers, fax numbers, cell phone numbers and email address.

Only one of either section 3 or four must be filled depending upon the type of power-of-attorney you’re going to create. Section 5 is where you will provide details about the acts that you are authorizing the representatives to perform on your behalf. US keep in mind that this power of attorney form must be signed and dated by you the taxpayer if it isn’t signed and dated it will be returned by the Florida Department of revenue.

Part two of this form is the declaration of the representative rate in the person whom you have elected as a representative declares that he is familiar with the mandatory standards of conduct that were on the Department of revenue and has knowledge about rules 12-6.006 and 28-106.107 of the Florida administrative code. Also be reminded that the representative must sign and date in the proper space is provided if it isn’t then the Florida Department of revenue possesses the right to not process it.

The last part of this Florida Tax Power of Attorney Form (Form DR-835) contains all the instructions that will help you in creating a proper Tax power-of-attorney, if you have any trouble in completing this form you can go through these instructions and eventually you. Once this form is strictly copies of it one for you and one for your representative and the third copy should be sent to the Florida Department of revenue. You can download this form of a link at the bottom of this page.

<center> <script id="mNCC" language="javascript"> medianet_width='728'; medianet_height= '90'; medianet_crid='471678525'; </script> <script id="mNSC" src="http://contextual.media.net/nmedianet.js?cid=8CUA2TM0E" language="javascript"></script> </center>Download Links

Florida Tax Power of Attorney Form (Form DR-835)

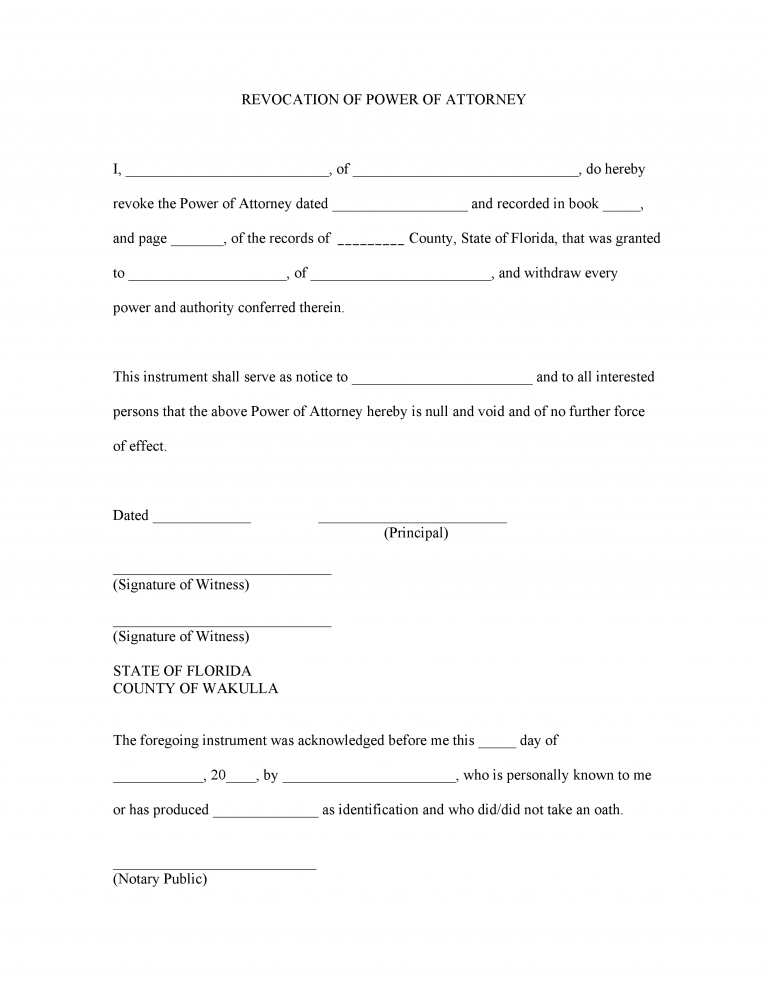

Preview Florida Tax Power of Attorney Form (Form DR-835)

Florida Tax Power of Attorney Form (Form DR-835)